What Medical Providers and Applicants Need to Know

Social Security Disability Breakdown

To apply for disability benefits from the Social Security Administration (SSA), applicants must qualify for Social Security Disability Insurance (SSDI) OR Supplemental Security Income (SSI). Yes, some applicants qualify for both!

SSDI – Social Security Disability Insurance

What Are the Qualifications?

Eligibility for SSDI is based on work history. Individuals must have worked full-time, on the books, for at least 5 of the last 10 years to apply. If you do not have a long, consistent work history, do not worry! Fortunately, the Social Security Administration has access to your earnings records, which is how they make the qualification determination.

Can I still apply if I worked off the books?

Applicants must have paid taxes toward social security; therefore, if you worked full-time, on the books, for 5 of the last 10 years, you should apply.

How much can I earn on SSDI?

Once applicants are approved for SSDI, benefits are calculated based on life-time earnings records.

SSI – Supplemental Security Income

What Are the Qualifications?

SSI is designed to provide disability benefits for individuals with a limited work history. To qualify, applicants cannot have more than $2,000 in assets, including bank account balances. Applicants are permitted to own one house or section of land where they reside and often one car. If an applicant is married, their spouse’s income and assets are also considered in the eligibility determination.

How much can I earn on SSI?

Unlike SSDI, SSI offers each applicant approved for disability benefits the same monthly payment of $914 for 2023, which adjusts annually to accommodate the increased cost of living.

Medical Eligibility

If an individual is eligible to apply for SSDI and/or SSI, they must show that they have a disabling medical condition based on Social Security’s standards; consequently, an applicant’s medical records must show limitations that match Social Security’s long list of regulations. Thus, a medical provider’s opinion alone cannot win a person’s disability benefits; there must be records revealing treatment, outcomes, provider’s assessments, imaging, etc.

SSDI and SSI determination is based on records from providers; therefore, SSA cannot approve an applicant to receive disability if there is no evidence of treatment for physical and/or mental health conditions. Applicants deemed disabled through Veterans Affairs or private disability insurance are not guaranteed approval for disability through SSA.

As a Medical Provider, How Can You Help a Patient Receive Disability Benefits?

If you have a patient who you believe should be on disability, there are many ways in which you can help!

- Providing comprehensive treatment notes after patients’ appointments can positively impact application decisions. SSA looks for details regarding symptoms, limitations (things patients can and cannot do), response to treatment, and how long symptoms and conditions are expected to last.

- If you receive a form from SSA or a lawyer’s office, including questions regarding a patient’s symptoms and limitations, kindly complete it to the best of your ability! Questions on these forms are designed to match SSA’s disability standards for different conditions.

- If you provide an opinion, make sure it complements your treatment notes. A provider can draft an excellent statement indicating the disability of a patient, but if the limitations discussed in the opinion do not match medical records, SSA will discredit the statement as “inconsistent.”

- If your patient does not have a representative, refer them to one! Not only is it difficult to win without representation, but the disability application and appeal processes can be overwhelming and challenging to navigate. Representatives serve to support clients and execute the demanding requirements.

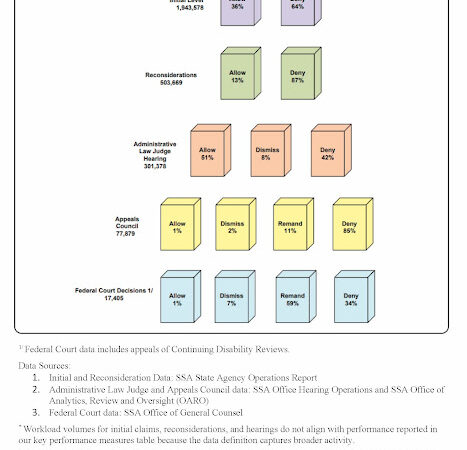

Have You Already Applied and Been Denied?

According to the Social Security Administration, from 2010 through 2019, only 21% of people who applied for disability were approved at the initial application level. A denial does not mean you are ineligible to receive disability benefits; you have the right to appeal SSA’s decision! The Law Office of Mark Schneider can help determine if appealing is in your best interest. Call (518) 566-6666 for a free consultation.

The Law Office of Mark Schneider prioritizes client rapport and transparency. Should a client lose, our staff will offer continued support. When clients win, SSA pays the representative directly. SSA laws permit representatives to earn up to $7,200 or 25% of past-due benefits, whichever is less.

Past-due benefits: an SSA payment most clients receive to cover a period in which the applicants were medically qualified for disability benefits but had not yet been approved to collect.